How much can i borrow with 60k income

I will be jobless for 18 months before my state pension and I owe 48500 on an interest-only mortgage. If youre married you can buy 20000 worth of I bonds in December and buy another 20000 of I bonds in January the following year.

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Answer 1 of 53.

. You use our free personal loan eligibility calculator to obtain an estimate of the loan amount you can borrow. However the amount you can borrow depends on the amount you qualify for. How much can I borrow for a personal loan.

30K a year for short-term expenses adds up to two 60K cars a 90K boat and a 90K home improvement project every decade. For the securitized loan is charging 2 interest so I dont see the loan as predatory. This coincides with her 4000000 a year income if she wants to be in the top 1 net worth echelon.

How much mortgage can you borrow on your salary. Receiving your pre-approval means you are ready to borrow funds. The price of the car you want to buy the price given to you by the dealership.

Visit FSLD to find out how you can qualify for total Student Loan Forgiveness by working for a qualifying 501c3 Non-Profit Organization. Read the source. If you need to borrow 6000 to consolidate debt finance car repairs or finance a home improvement project you should be able to justify borrowing the money.

The idea is to contribute enough so that the 529 plan can comfortable cover most if not all of your childs college expenses when the time comes. A week of Canadian heli-skiing costs even less. Borrowers also can release their co-signers after 36 monthly payments and graduates can refinance federal PLUS loans in their own names that their parents took out.

The usual rule of thumb is that you can afford a mortgage two to 25 times your income. How Much Should My Net Worth Be By Income. On a 5 year scheme this will be 15th of the 40000 discount and on a 3 year scheme this will be 13rd of the 40000 discount given.

Quitting isnt looking like a near-term possibility unless things rapidly take off investing wise which may happen. Im still currently working at the same job. As long as you can afford the monthly payment and have a good use for the funds you should get a personal loan.

This is an anomaly that wont last forever. My opinion probably anything 25k upwards but it all depends on your spending habits ect. At 60000 thats a 120000 to 150000 mortgage.

For background I am a father of two young children. Steve Webb replies in his 300th column. Lenders will most likely ask for proof of income so if you submit accurate information and have it readily available you will be one step ahead of the game.

However if you need 6000 to go on a luxury vacation you may still be able to justify the loan although it may not financially benefit you. The value of your trade-in if you have one the value of your existing vehicle which youll usually trade in at the. This article provides a proper framework for 529 plan contributions by age.

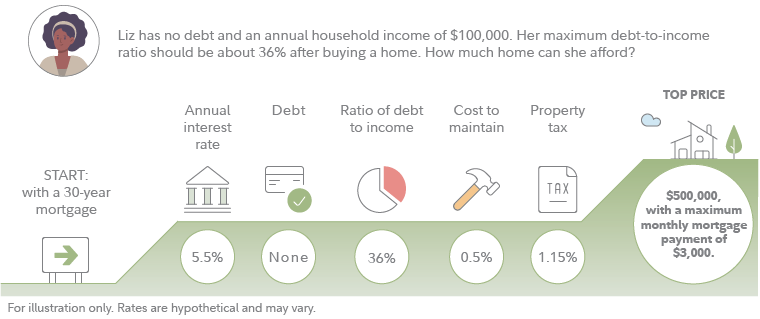

Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability criteriaIn some cases we could find lenders willing to go up to 5 times income. In fact only 25 of American households have income over 100000 and only 6 over 200000 with half of those between 200000 and 250000. We can consider stipend income where.

Determinants can include income credit score debt-to-income ratio on-time payment history and more. Eligible customers can get top-up loans at competitive rates with minimal documentation. How to Calculate an Auto Loan.

The median physician income is approximately 200000 and the median household income in the United States is about 52000 per year and that often includes two partners working. One can therefore conclude that a top 1 income-earning 35 year old should have 2000000 in net worth. Extra Details Loan terms.

In most cases you should have a 650 or higher credit score if you are applying for a 50000 personal loan. To calculate an auto loan you need to determine several factors. Compared to a credit card personal loans usually have much lower interest rates.

Your down payment a sum of money you pay upfront toward the value of your car. On approved personal loans you can borrow 50000 or maybe even more. You can have an awful lot of fun for 30K.

For information about becoming an AFR partner so you can offer DPA Advantage to your clients visit here email or call 1-800-375-6071. A week in Belize bought at the last minute was only half that. In most cases a 2000 personal loan is a good idea.

Making money means nothing if you have nothing to show for it. In a few exceptional cases you might be able to borrow as much as 6 times your annual income. Quitting isnt looking like a near-term possibility unless things rapidly take.

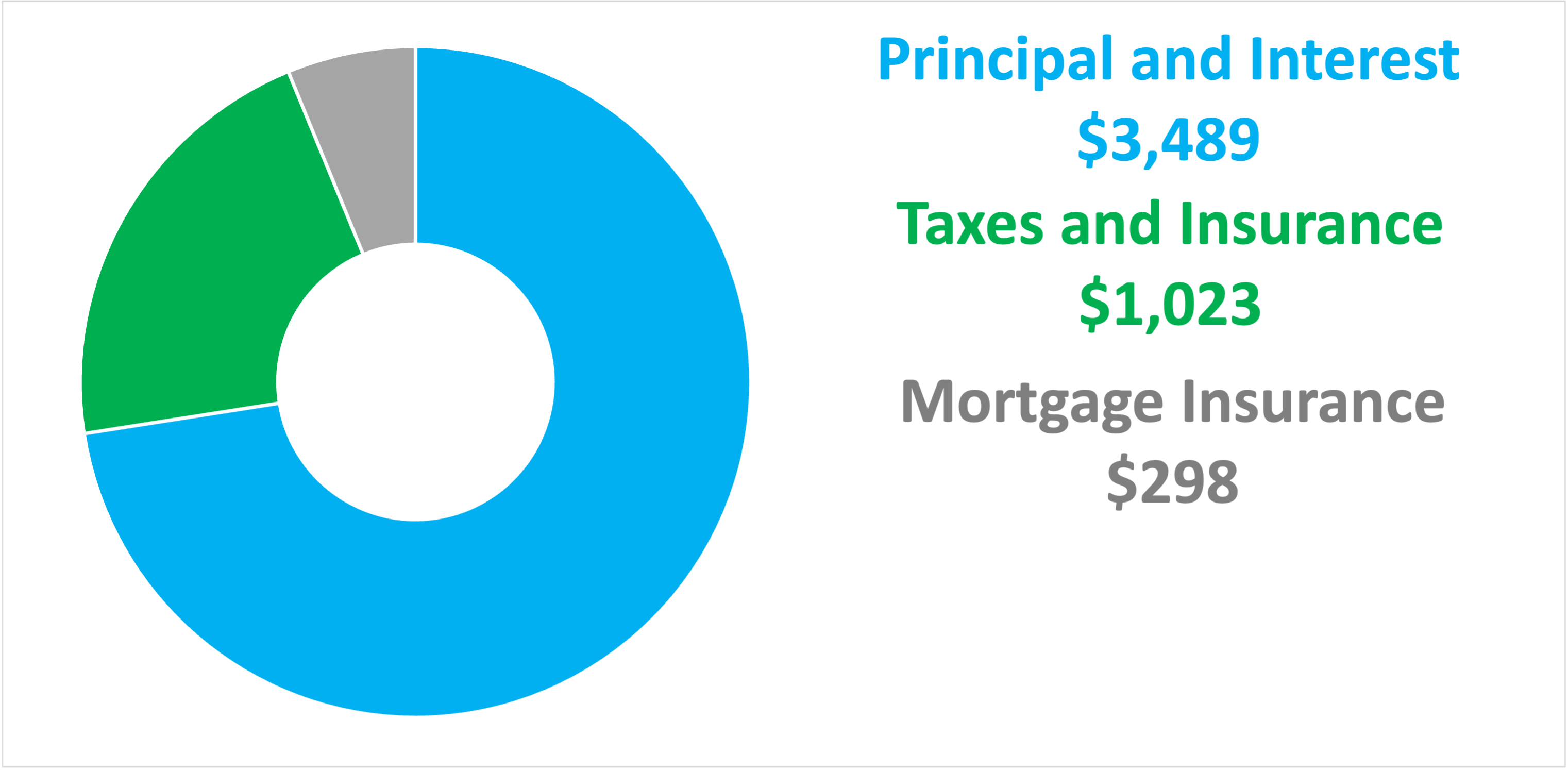

Wondering how much to contribute to a 529 plan. The amount due is about 60K in principal 2K in interest and fees and 10K in taxes and insurance after a credit for. Many NYC neighborhoods that have been upper income for decades including much of the Upper East and West Sides were once redlined.

When graduating I heard about a company called student loan direct 1 which offers services to assist with choosing the right plan and staying on top of repayment. How much you can borrow in the form of a personal loan is determined by various factors that include age residence ongoing loans etc. I earn just shy of 19k a year I have 3 children so me and my partner on top get what youd call benefitssocial assistance of about 1200 a month because of.

Joint 50K 60K Meets minimum income - 100k combined income criteria. We will allow them to borrow 60000 plus some additional money for home improvements. How amazing is it that we can borrow at a negative real rate yet earn a positive real guaranteed rate.

Typically lenders use a variety of determinants when evaluating applications. 60k Personal Loans 75k. How much in hand salary will I get if my CTC is Rs8 LPA in Cognizant.

Data covering the first three months of the year shows that 4500 products a month have been taken out by the over-55s as they tap equity in their homes for cash. Some lenders offer personal loans up to 100000. Both of their plans were superfunded the.

How Much Mortgage Can I Afford if My Income Is 60000. DPA Advantage can also be combined with an FHA 203k renovation loan allowing your clients to consider a wider range of homes. Youve got to.

10K was two weeks of reckless spending in France. Im about 2 years in with 60k. Gathering your tax returns can help you identify exactly how much income you can prove.

IT will be in the region of about Rs60000- per month on an average assuming you would get 100 of variable pay being paid if any as per the payout period assuming you will take 100 of eligible HRA as HRA when you use old tax regime. Investors who itemize their federal income taxes can deduct investment interest expense of margin loans against their net investment income. Would it make any sense for a pre-FI person house hunting to keep investing instead of saving up 60k-120k in a high-yield savings and then take out a margin loan on that portfolio.

If your credit score is 650 or below you may still qualify if your income is high enough.

I Make 60 000 A Year How Much House Can I Afford Bundle

Why Households Need 300 000 To Live A Middle Class Lifestyle

How Much House Can I Afford Fidelity

Pinterest Project Live Like No One Else Dave Ramsey Quotes Dave Ramsey Inspirational Quotes

How Much House Can I Afford Calculator Money

Borrowing Power Calculator Sente Mortgage

Money Advice On Tiktok Is Using Life Insurance To Fund Retirement Actually A Good Idea For Young People Money Advice Investing For Retirement Life Insurance Agent

Schwab Moneywise How Much House Can You Afford

Mortgage Required Income Calculator Capital Bank

How Much Mortgage Can I Afford If My Income Is 60 000

The Minimum Income Necessary To Afford A Five Million Dollar House

The Minimum Income Necessary To Afford A Five Million Dollar House

Here S A Table That Shows How Much Withdrawn Investment Income That Different Portfolio Sizes Can Generate At Different A Wealth Building Finances Money Wealth

Pin By Nigeria Income Coach On 72 Hour Income Generator Affiliate Marketing Training Marketing Professional Internet Marketing

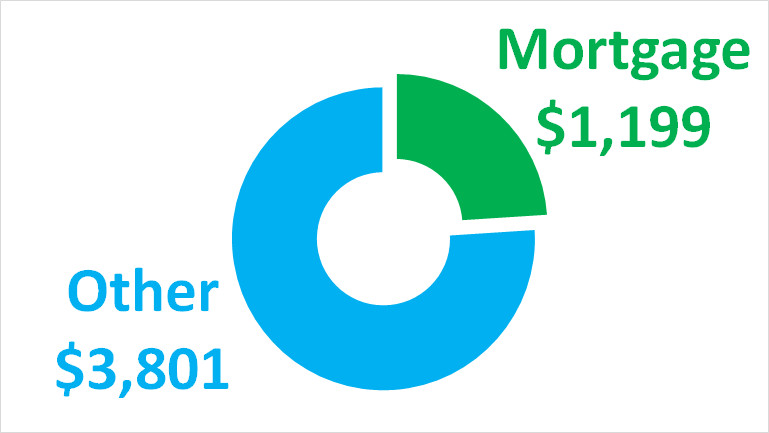

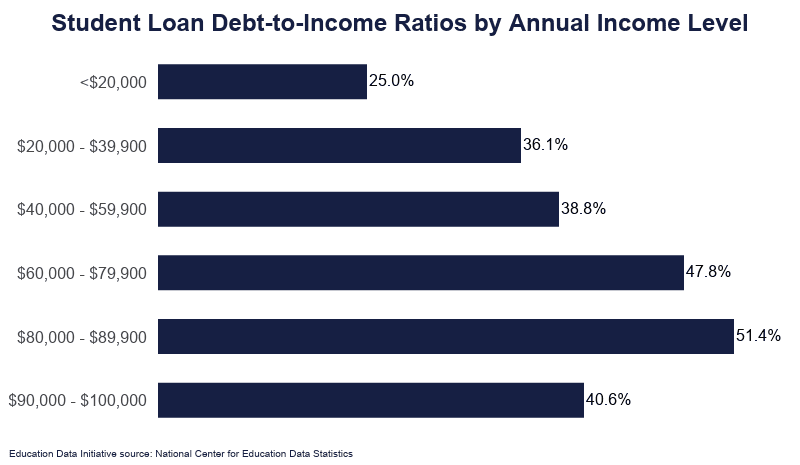

Student Loan Debt By Income Level 2022 Data Analysis

Who Owes The Most In Student Loans New Data From The Fed

650k Mortgage Mortgage On 650k Bundle